san fran sales tax rate

The latest sales tax rate for South San Francisco CA. This includes the rates on the state county city and special levels.

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California.

. 2020 rates included for use while preparing your income tax. The minimum combined 2022 sales tax rate for San Francisco California is. There is no applicable city tax.

What is the sales tax rate in San Francisco California. For a more detailed breakdown. This is the sum of the sales tax rates in the state county and city.

This is the total of state county and city sales tax rates. Method to calculate San Francisco sales tax in 2021. The average cumulative sales tax rate in San Francisco California is 864.

The base sales tax in California is 725. Payroll Expense Tax. The latest sales tax rate for San Francisco County CA.

1788 rows California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. The minimum combined sales tax rate for San Francisco California is 85.

Choose city or other locality from San Francisco. What is the sales tax rate in South San Francisco California. 2020 rates included for use while preparing your income tax.

The minimum combined 2022 sales tax rate for South San Francisco California is. This rate includes any state county city and local sales taxes. While many other states allow counties and other localities to collect a local option sales tax.

This is the total of state county and city sales tax rates. Parking Operators file and pay taxes monthly and have additional requirements. San Francisco County California Sales Tax Rate 2022 Up to 9875.

San Francisco Californias minimal combined sales tax rate for 2020 is 85 percent. The 8625 sales tax rate in San Francisco consists of 6 Puerto Rico state sales tax 025 San Francisco County sales tax and 2375 Special tax. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375.

This is the total of state county and city sales. Method to calculate San Francisco County sales tax in 2021. The 85 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 225 Special tax.

2020 rates included for use while preparing your income tax. How much is sales tax in San Francisco. The South San Francisco California sales tax is 750 the same as the California state sales tax.

This rate includes any state county city and local sales taxes. As we all know there are different sales tax rates from state to city to your area and everything combined is the. The latest sales tax rate for San Francisco CA.

The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025. This rate includes any state county city and local sales taxes. For a list of your current and historical rates go to the.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself. 0875 lower than the maximum sales tax in CA.

The City currently imposes a 25 tax on total parking charges for all off-street parking throughout the City. There is no applicable city tax.

Sales Tax Collections City Performance Scorecards

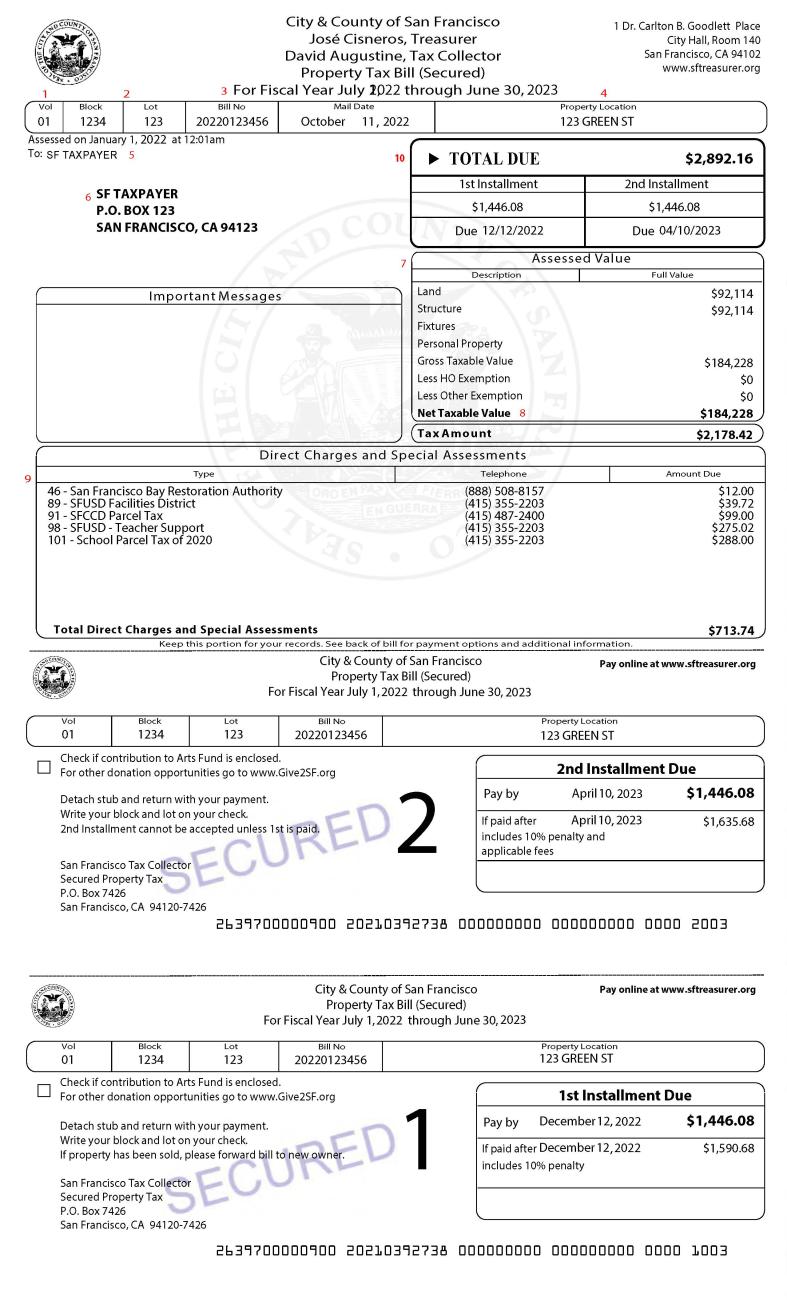

Secured Property Taxes Treasurer Tax Collector

California Sales Tax Rate Changes January 2013 Avalara

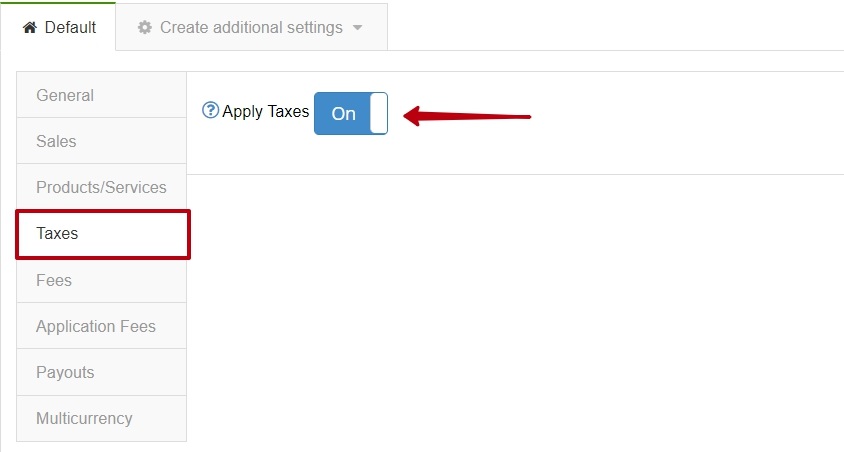

How To Set Up Sales Tax In Quickbooks Online Or Xero Synder

San Francisco Feels A Tax Base Chill With First Drop In 25 Years Bloomberg

California Sales Tax Rate Changes April 2016 Avalara

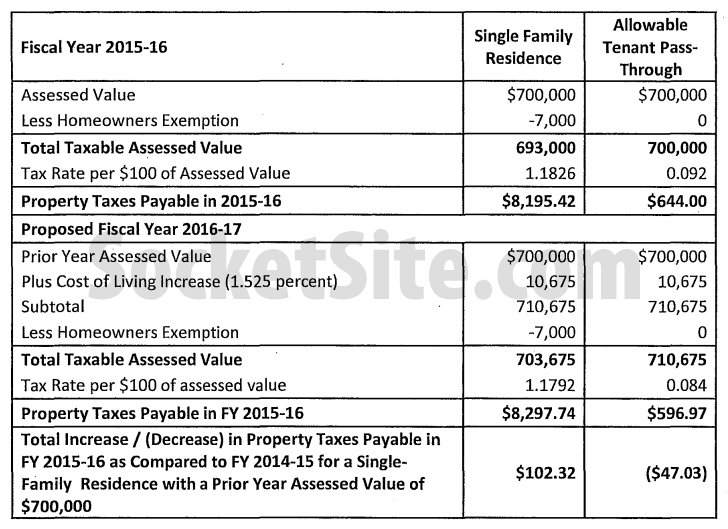

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go

State And Local Sales Tax Rates Sales Taxes Tax Foundation

What S This S F Mandates Surcharge Doing On My Restaurant Check An Explainer

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

U S Cities With The Highest Property Taxes

![]()

Tracking The San Francisco Tech Exodus Sf Citi

Tracking The San Francisco Tech Exodus Sf Citi

How Much Is Weed Tax In San Francisco Lajolla Com

Sales Tax On Saas A Checklist State By State Guide For Startups

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Free Llc Tax Calculator How To File Llc Taxes Embroker

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen